affordable again?

Analysis by Ben Everidge for Thomas

The Promise on trial …

President Trump told supporters this week – at what appeared to be a Fort Bragg campaign-style appearance – that the economy has improved. The claim is politically intuitive: a president wants a simple story, and “better” is a powerful word. But affordability is not a vibe. It is arithmetic – what a typical household pays each month to live a normal life.

What a Typical Household Pays Monthly

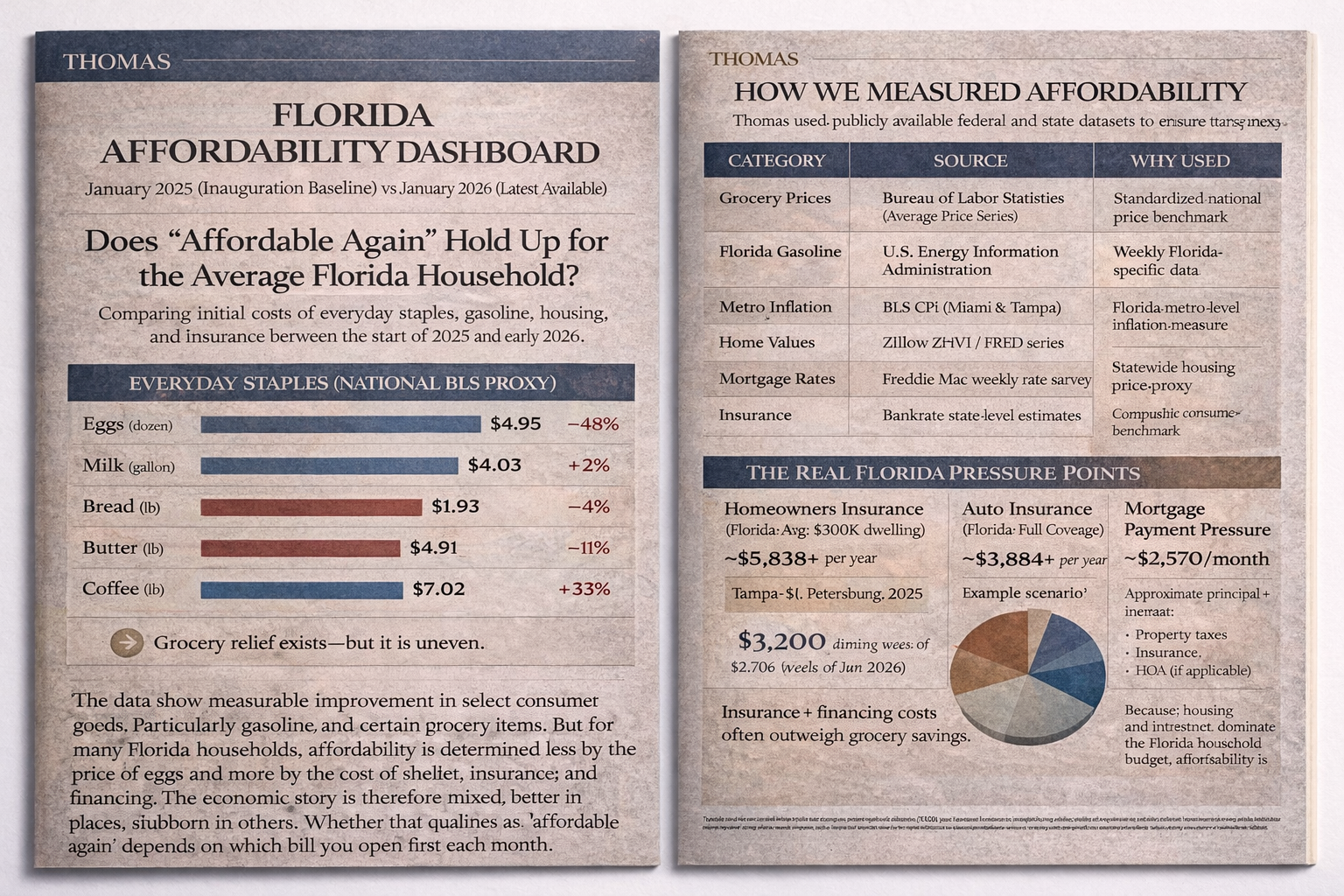

Start with groceries, because that is where voters notice price changes immediately. The data offers a mixed verdict. Several staples used in everyday kitchens have eased meaningfully compared with early 2025 – eggs and butter notably – while others remain stubborn or slightly higher. In political terms, this is the kind of evidence a White House will highlight: “Look – prices are down!” And on a narrow list of items, that can be true.

But groceries are only one line of the household budget, and Florida – our home state and Donald Trump’s now too – is not a “groceries-only” state. Florida is a shelter-and-insurance state. And this is where the promise collides with the lived experience, which we are certain can be found in many other American states as well.

Consider what “affordable” means to the median household: can you make the rent or mortgage payment without rearranging the rest of life? Home prices have not behaved like a clean relief story. Even where values stabilize or soften in pockets, the payment burden can remain high when mortgage rates hover near the levels seen around inauguration week. A household does not but a “home value index.” It buys a monthly payment.

Then there is insurance – the most politically under-discussed cost driver in Florida and one of the most relentless. Homeowners insurance in Florida sits in a different category than most states, and auto insurance often follows. When insurance renewals jump, the consumer doesn’t experience it as “inflation.” They experience it as a new bill that behaves like a tax. Even when state leaders argue reforms are helping, many households won’t feel “affordable again” until premiums stop feeling like a second mortgage.

Gasoline, too, matters in a state build around driving, especially outside a handful of dense urban cores. Florida pump prices swing with global energy and regional refining realities, and they are psychologically powerful because they are seen weekly. If you want to understand why a president frames success around “the economy,” watch how often voters frame it around the price sign on the road.

The Assessment One Year In

So what is the accurate verdict, one year into Mr. Trump’s second term at 1600 Pennsylvania Avenue. After all, Mr. Trump did promise during his campaign to fix the economy on “day one.”

The honest answer is that the affordability story is split-screen. Some consumer goods have cooled; that’s real. But for many Floridians, and Americans, the big-ticket pressures – housing payments, insurance, and other fixed monthly obligations – continue to dominate the emotional and financial landscape. Which means a claim that “the economy has improved” can be simultaneously defensible in macro indicators and unpersuasive at the kitchen table.

The political implication is straightforward: whoever wants to win Florida in 2028 – Trump’s MAGA party, Democrats, or an organized independent movement – must stop speaking in slogans and start speaking in household math.

“Affordable again” is not a tagline. It is a measurable contract.

The Research & Methodology

To strengthen our credibility in your mind, especially with independents who we admittedly align with, here is the research and methodology we used so you can see exactly how our conclusions were reached.

The data show measurable improvement in select consumer goods, particularly gasoline and certain grocery items. But for many Florida households, and we suspect many American households as well, affordability is determined less by the price of eggs and more by the cost of shelter, insurance, and financing. The economic story is therefore mixed in our opinion: better in places, stubborn in others. Whether that qualifies as “affordable again depends on which bill you open first of each month.

What is certain? Mr. Trump did not make the American economy better on day one as promised, and has a long way to go to make his Fort Bragg boast true that life in America is now more affordably than it was before he took office again on January 20, 2025.